Can i borrow 5 times my salary for a mortgage

Most mortgage lenders use an income multiple of 4-45 times your salary some offer a 5 times salary. While its true that most mortgage lenders cap the amount you can borrow based on 45 times your income there are a smaller number of.

Families Struggle To Afford College Realclearpolitics College Costs College Private School

Most providers are prepared to lend up to 4 - 45x your annual income which in this instance means that you will need to bring home a minimum of 66667 - 75000 a year combined.

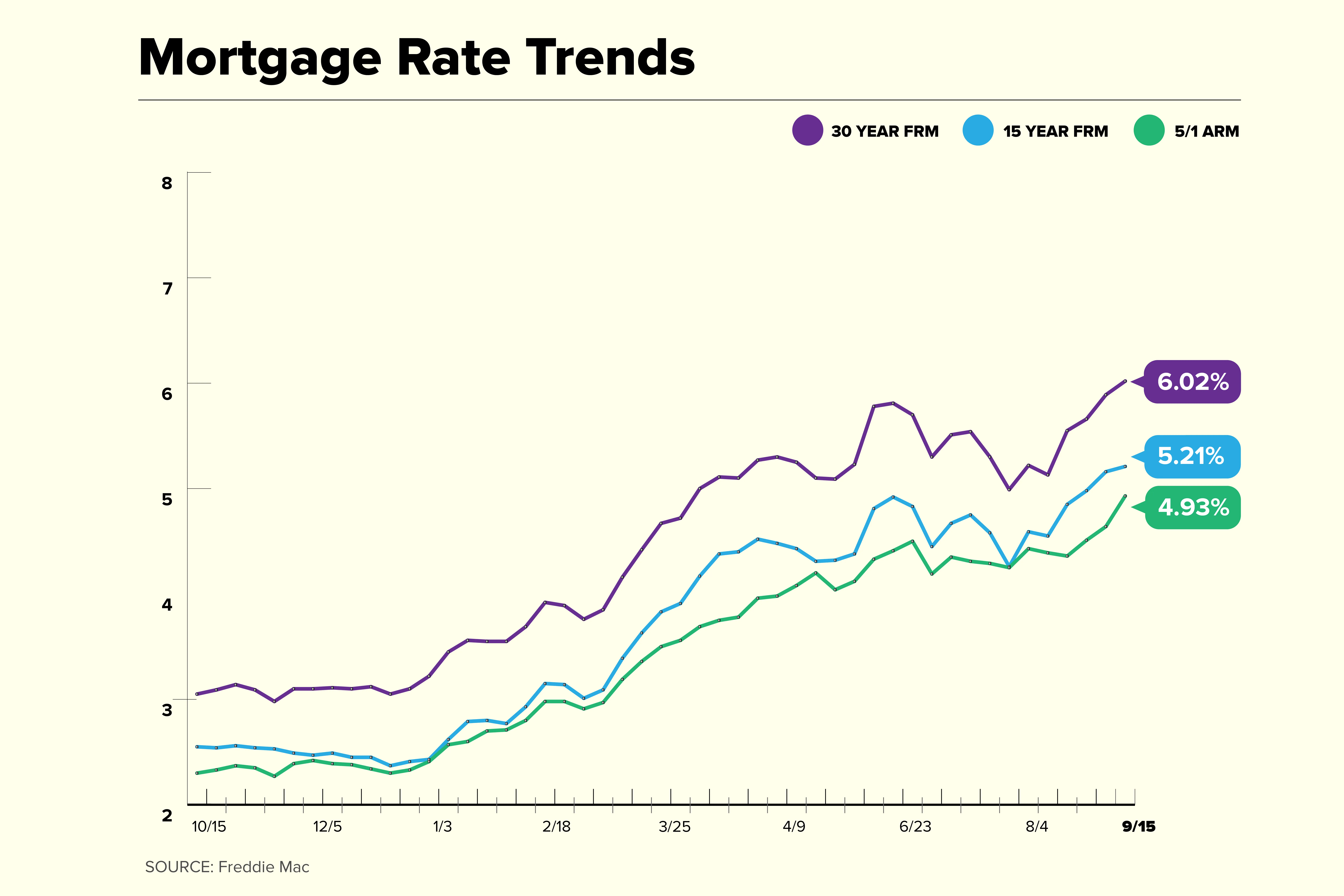

. If the positive balance is five times your monthly repayment a lender may approve. 34 Mortgage calculator 5 times salary Kamis 08 September 2022. Nine banks and building societies currently allow customers to borrow five times their income but the earnings requirements vary from 13000 a year to 100000.

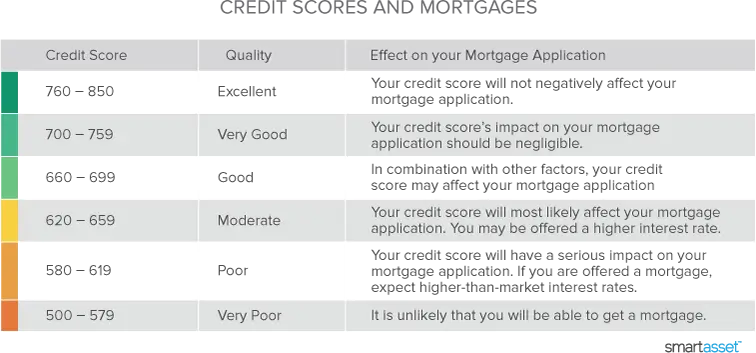

When you apply for a mortgage lenders calculate how much theyll lend based. Ad Compare Your Best Mortgage Loans View Rates. Many potential borrowers will not be eligible for this type of mortgage based on size of deposit income employment status as self-employed are excluded from many of these.

Everything You Need To Know. As a single applicant the maximum amount person 1 could borrow for a 5x salary mortgage is 150000. Find Useful And Attractive Results.

Nationwidewill allow people looking to get on the housing ladder to borrow 55 times their annual income more than the 45 loan-to-income ratio most lenders offer. Yes you can borrow up to 45 times your salary from a mortgage lender as long as you match their criteria. Can you get a mortgage for 55 times your income.

Ad Search For How Much Of A Mortgage Loan Can I Get. Lock Your Mortgage Rate Today. Most mortgage lenders use an income multiple of 4-45 times your salary some offer a 5 times salary mortgage and a few will use 6 times salary under the right.

If your income nets a positive balance youre on your way to obtaining a mortgage. For example of those lenders with a minimum. This would be based on you having little to no debt and an average UK salary or.

Imagine person 1 earns 30000 a year and person 2 also takes home 30000. Get the Right Housing Loan for Your Needs. For this example well base the maximum borrowing amount on two incomes.

Lenders will typically use an income multiple of 4-45 times salary per person. Ad Learn More About Mortgage Preapproval. Ad First Time Home Buyers.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Lock Your Mortgage Rate Today. Ad Were Americas Largest Mortgage Lender.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your. Apply Now With Quicken Loans. Take the First Step Towards Your Dream Home See If You Qualify.

Most lenders cap the amount you can borrow at just under five times your yearly wage. How much income do you need to qualify for a 450 000 mortgage. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Not all lenders have a minimum income requirement but those that do typically have stricter criteria the more you borrow. Lender Mortgage Rates Have Been At Historic Lows. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

With the addition of applicant 2 the combined mortgage size increases to 250000. As a single applicant the. It is possible that you will be able to borrow 45 times your salary and possibly even 5 times your salary.

Most mortgage lenders use an income multiple of 4-45 times your salary some offer a 5 times salary mortgage and a few will use 6 times salary under the right circumstances to work out. Do lenders lend 5 times salary. Compare Mortgage Options Calculate Payments.

Borrow up to 6 times your salary if you have no other debt This drastically affects how much they can borrow for a mortgage. Ad Were Americas Largest Mortgage Lender. Its possible to borrow five times my salary for well-qualified homebuyers.

In general the bank will lend us 80 of the appraisal or sale value of the property so if with our salary we can ask for a mortgage of 100000 euros we will be able to. Compare Offers Side by Side with LendingTree. Note both loans aim for a 36 DTI which is typical for a.

Each lender has their own maximum income multiple meaning the maximum amount theyll lend. DistributeResultsFast Is The Newest Place to Search. Browse Information at NerdWallet.

Apply Now With Quicken Loans. Compare Mortgage Options Calculate Payments. Yes it is possible.

Check Your Eligibility for a Low Down Payment FHA Loan. Take Advantage And Lock In A Great Rate.

How To Pay Off Your Mortgage Early 5 Simple Ways Forbes Advisor

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

How Many Names Can Be On A Mortgage Bankrate

5 Times Salary Mortgage Lenders Who Offers Them Mortgageable

Getting A Mortgage 5x Your Salary

Annuity Calculator For Excel Annuity Calculator Annuity Annuity Retirement

One Way To Eliminate Your Student Loans In Your Spare Time Student Loan Payment Student Loans Retirement Money

Agbo5fvxuoyi1m

5 Year Fixed Mortgage Rates And Loan Programs

Can I Borrow Five Times My Salary Mortgage House

How To Pay Off 100k In Student Loans 5 Strategies To Consider Student Loan Hero

5 Things To Know About The Chime Credit Builder Visa Secured Credit Card Forbes Advisor

Getting A Mortgage 5x Your Salary

How Much House Can I Afford Fidelity

5 Reasons To Not Pay Off Your Mortgage Early Real Estate News Insights Realtor Com

5 Surprising Income Types Mortgage Lenders Allow

How Much Mortgage Can I Afford Smartasset Com